Category: IncomeTax

-

At the stroke of midnight tonight…

1. Have a happy new year! & 2. If you use your personal vehicle for business purposes, go out to your car and take an odometer reading.

-

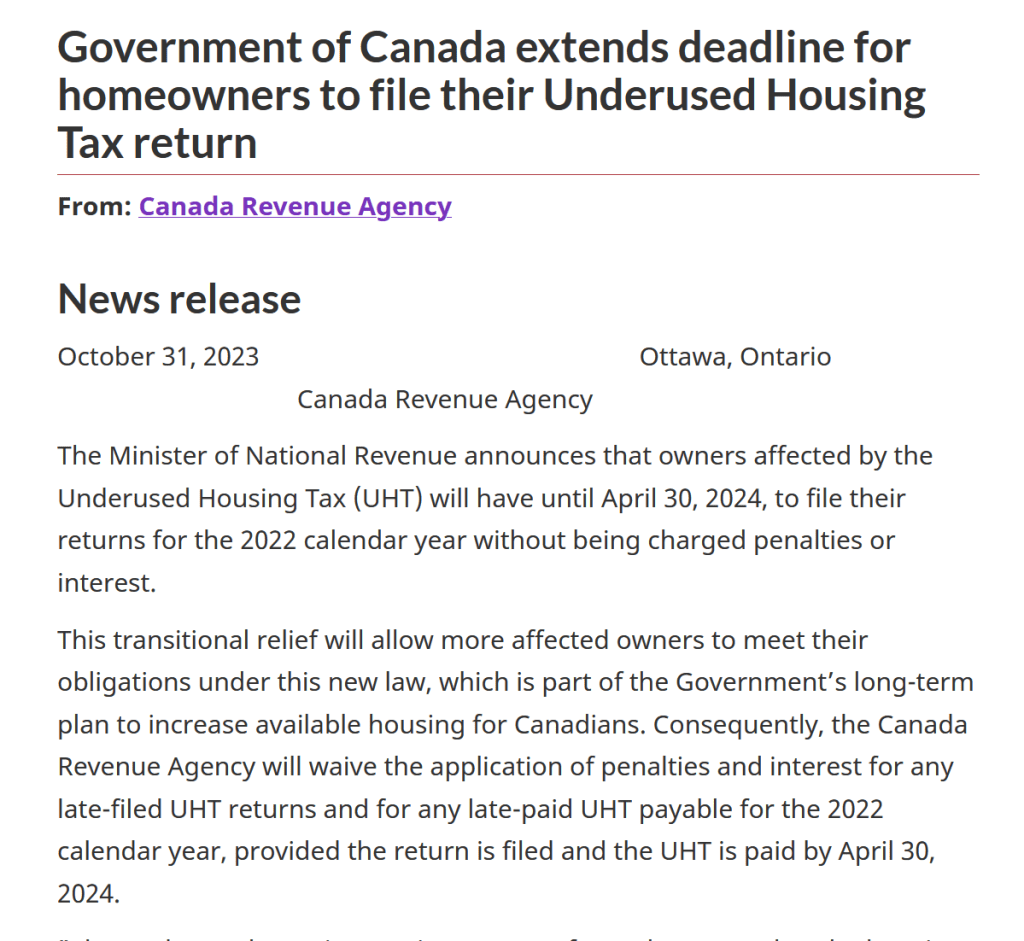

Government extends deadline for filing UHT return

Phew! This new tax and related return can cause you to rack up some hefty fines if you file late, so I’m glad folks are getting more time to figure out whether or not it applies to them. I’m used to reading government documents and learning new things about our tax system, but I find…

-

Long weekends are a good time to tackle to do lists

And, as the personal income tax deadline is coming up fast – May 1 this year! – here are some suggestions.

-

Canada Housing Benefit application deadline – Friday March 31

Are you a renter with a low income ($20,000 or less for individuals, $35,000 or less for families)? If so, you may be eligible for a one time tax-free payment of $500, but applications close tomorrow. Please see the links below for more info. Click here to go to the CRA site to learn more

-

Free GST/HST webinar

The CRA has been putting a real effort into helping people learn what we need to know as citizens, taxpayers, and business-owners. Here’s an upcoming offering about GST/HST filling responsibilities. fb://photo/521774023478435?set=a.165610979094743&sfnsn=mo&mibextid=6aamW6

-

This is it, folks: tax time!

Tax time is upon us. Please note these upcoming deadlines: Please contact me asap at suzie@diamondbookkeeping.ca to get friendly, supportive tax preparation services.

-

CRA online outages

Please be aware that, due to system maintenance, many CRA online services will be unavailable between now and February 20th. The start and end dates of the service interruptions vary, but will affect several common tasks such as online filing of your personal or trust tax return (by a professional tax preparer) and the ability…

-

Volunteer tax preparation

Did you know that, if you have a modest income and only need a simple tax return prepared, you may be able to get this done through a volunteer tax clinic? The Community Volunteer Income Tax Program (CVITP) is a collaboration between the Canada Revenue Agency and local community groups. The CRA screens and trains…

-

Ontario Staycation Tax Credit

Are you an Ontario resident who did some travelling within Ontario this year? If so, make sure you keep your receipts for your accommodation expenses – such as for a hotel, cottage, or campground – because you can claim this on your 2022 taxes. The Details: For more information, see the Government of Ontario website

-

Ontario Seniors Care at Home Tax Credit | ontario.ca

Tax credits reduce the amount of tax you have to pay. Non-refundable tax credits can reduce your taxes down to 0; refundable tax credits are even better because they can actually allow you to get or increase the size of a refund. Ontario Seniors Care at Home Tax Credit is a refundable tax credit, which…